Mumbai (Maharashtra) [India], December 29: India’s medical devices industry is no longer a side act. It’s becoming a mainstay of the healthcare economy, with momentum that looks stubbornly durable.

How Big Will the India Medical Devices Industry Be by 2033?

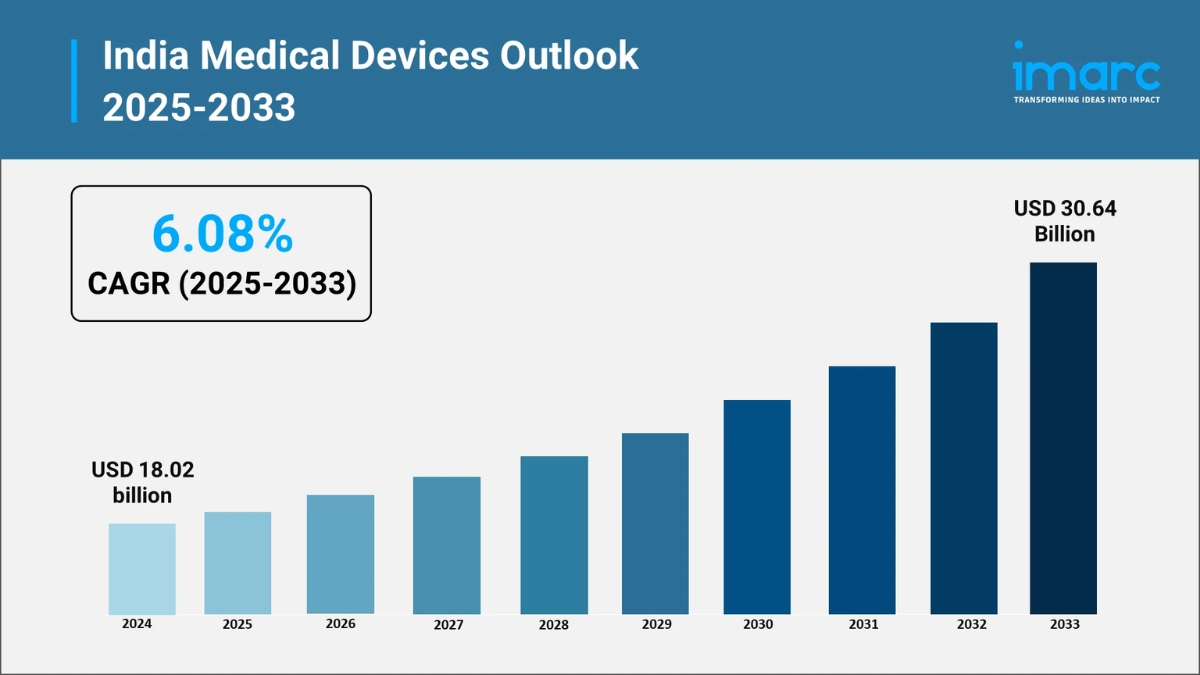

Let’s start with the number that matters. The India medical devices market size is expected to reach USD 30.64 billion by 2033. That’s not hype. That’s math backed by hospitals, demographics, and policy.

In 2024, the market stood at USD 18.02 billion. Between 2025 and 2033, it’s growing at a CAGR of about 6.08 percent. Not explosive. Not fragile either. Steady, compounding, and broad-based.

What’s powering this growth isn’t one silver bullet. It’s a convergence. More hospitals. More chronic disease. More local manufacturing. And a quiet but decisive shift toward portable and home-based care.

Hospitals, Clinics, and Diagnostics Are the Demand Engine

India’s healthcare delivery system is expanding in every direction at once. New hospitals. Bigger specialty centres. Diagnostic chains that look more like national brands than local labs.

This expansion creates relentless demand for medical devices. Capital equipment like imaging systems and ventilators. Everyday essentials like consumables and disposables. And everything in between.

Hospital capacity is scaling up fast. More ICU beds mean more patient monitors and ventilators. Upgraded operation theatres require modern anesthesia systems and surgical tools. Diagnostic labs are investing heavily in MRI, CT, and PET-CT systems, while also adopting compact point-of-care testing devices for speed and throughput.

There’s also a structural shift in how hospitals buy. Large private chains such as Apollo, Fortis, and Manipal are expanding aggressively. Private equity has noticed. India’s hospital sector has attracted nearly USD 4.96 billion in PE funding, a signal that organised healthcare is here to stay.

Organised players don’t buy devices casually. They prefer bundled contracts that include installation, servicing, maintenance, and consumables. For manufacturers, that means predictable revenue and longer relationships. For hospitals, it means fewer headaches. Everyone wins, assuming you can deliver.

Market Size, Growth, and Where the Real Opportunity Lies

The India medical devices market size reflects more than rising spend. It reflects changing disease patterns.

Chronic illnesses are climbing. Diabetes, cardiovascular disease, respiratory conditions. These aren’t episodic problems. They require continuous diagnosis, monitoring, and therapy. That translates directly into sustained device demand.

Government policy is adding fuel. The Production Linked Incentive scheme, medical device parks, and regulatory support are nudging manufacturers to build locally. Imports still dominate high-end devices, but that gap is narrowing.

Technology adoption is another accelerant. Digital health monitoring, portable diagnostics, and connected devices are moving from pilot projects to standard practice. Consumers are more aware. Doctors are more data-driven. Hospitals are more tech-forward.

Strategically, companies model three scenarios. A base case with steady growth. An upside case where localisation and exports surge. And a downside case tied to weaker hospital spending or supply chain shocks. The common thread across all three? Portable and home care devices outperform the average.

Import Dependence Meets Domestic Manufacturing Reality

India still imports a large share of high-end medical devices. Advanced imaging systems. Implants. Sophisticated diagnostics. Between FY2020-21 and FY2024-25, imports of electromedical equipment and surgical instruments crossed USD 25 billion.

That dependence carries risk. Currency swings. Tariff changes. Global supply disruptions. Hospitals feel it first, and patients feel it next.

But here’s the flip side. This import-heavy structure is an open invitation for domestic manufacturing, especially in low- and mid-complexity devices. These categories face fewer technological barriers and enjoy consistent demand.

Policy support is finally aligning with opportunity. The PLI scheme, device parks, and faster regulatory pathways are pushing both Indian firms and multinationals to manufacture locally. Assembly lines are coming up. Component manufacturing is scaling. R&D centres are expanding.

Beyond manufacturing, services matter. Maintenance, calibration, and consumables supply offer recurring revenue and healthy margins. Quietly, these segments are becoming profit engines.

Portable and Home Care Devices Are the Fastest Movers

If there’s one segment rewriting the rules, it’s portable and home care equipment.

Blood pressure monitors. Glucometers. Digital oximeters. Portable ECGs. CPAP machines. Mobility aids. These devices are no longer fringe products. They’re becoming household essentials.

The drivers are obvious. Chronic disease requires frequent monitoring. India’s elderly population is growing. Telemedicine has gone mainstream. Doctors now trust validated home readings for virtual consultations.

Technology has kept up. Sensors are cheaper. Batteries last longer. Devices are smaller and smarter. Smartphone connectivity seals the deal.

Global players see the opening. Omron is setting up manufacturing in Chennai to localise blood pressure monitors and ECG devices. Penetration remains low, roughly 6 percent for BP monitors, despite massive hypertension prevalence. That gap is opportunity staring you in the face.

Market data consistently shows home healthcare monitoring growing faster than the overall medical devices market. Companies that build strong links with pharmacies, e-commerce platforms, and telehealth providers will capture disproportionate value.

Government Support Is No Longer Cosmetic

Policy support has moved from slogans to spreadsheets.

Under the PLI scheme, manufacturers receive incentives tied directly to incremental sales. By March 2023, 21 companies were approved across imaging, cardio-respiratory devices, implants, and cancer-care equipment. Another 50 greenfield plants are expected under the broader pharma and medical device PLI framework.

Medical device parks are adding muscle. Shared testing labs. Infrastructure support. Faster approvals. State governments are competing to attract investment, which is exactly how it should be.

For manufacturers, ignoring these incentives is lazy strategy. Used well, they improve returns, reduce payback periods, and strengthen export competitiveness.

Competitive Landscape Is Heating Up

This is not a sleepy market.

GE Healthcare dominates imaging, diagnostics, and patient monitoring, with a growing local manufacturing and R&D footprint. Siemens Healthineers is pushing hard on advanced imaging and AI-driven diagnostics. Its Bengaluru MRI facility under the PLI scheme is a clear signal of long-term intent.

Philips Healthcare plays across imaging, critical care, and home health, with a strong focus on connected care. Mindray has carved out share by offering capable devices at aggressive price points, especially in monitoring and anesthesia.

Indian players are no longer content with crumbs. Trivitron Healthcare spans diagnostics, imaging, and critical care, backed by acquisitions and overseas facilities. BPL Medical Technologies remains strong in monitoring, ECGs, defibrillators, and home health equipment.

The pattern is clear. Multinationals dominate high-end capital equipment. Domestic firms win in consumables, monitoring, and value-driven categories. The gap is narrowing, and competition is sharpening.

What This Means Going Forward

India’s medical devices industry is moving from dependency to capability. From fragmented demand to organised procurement. From hospital-only use to home-based care.

The India medical devices market size tells a story of scale. The subtext tells a story of resilience and opportunity. Companies that focus on affordability, localisation, and innovation won’t just participate. They’ll lead.